What Matters Now

What’s On Your Mind?

Latest Articles

Prioritize actions that will protect your business in the transition to a low-carbon economy.

Canadian businesses have been getting messages that appear to be from trusted sources, but are actually from fraudsters.

Planning to buy your first home in Canada? There’s more to it than mortgages and down payments. Learn about hidden costs and investment strategies…

Did You Know?

44% of Canadians were not prepared for the impact of inflation

Source: RBC 2023 Financial Independence Poll

Most Popular

-

RRSP Contribution Deadline & Limits Guide

Get all the info you need about Registered Retirement Savings Plan (RRSP) contributions before the upcoming deadline.

-

Don’t Panic: 4 Tax Filing Tips for Freelancers, Solopreneurs and Self-Employed

Keep up with your income tax responsibilities as your business evolves

Which of the following Cyber Security issues do you struggle with the most?

- Remembering passwords (46.53%)

- Recognizing phishing attempts (9.06%)

- Keeping devices secure from hackers (19.91%)

- Staying up to date with security practices (0%)

Discover practical ways Canadian parents can teach kids and teens about money. From first bank accounts to investing basics, help your children build…

At Canada Climate Week Xchange, RBC and Carbonhound convened food system leaders to explore how Canada can strengthen its global competitiveness.

Raising a child comes with real costs, but fewer surprises when you know what to expect. See how the numbers break down by age and how smart planning…

Did You Know?

67% of Canadians are concerned about their cash flow

Source: RBC 2023 Financial Independence Poll

Tools & Calculators

See How Much You Could Save in a Registered Retirement Savings Plan

Quickly See What Your Mortgage Payments Might Look Like

Estimate the cost to buy and own an electric vehicle in Canada, compared to a gas model.

Ideas & Voices

Learn how CDIC (Canadian Deposit Insurance Corporation) works, what accounts it protects, how much it covers and how to maximize your coverage.

What makes these accounts different from each other? Which one earns the most interest? Which one is the best fit for me? To answer some of your…

Don't know if you need a chequing account, a savings account, or both? We explain the difference and help match you with the right account.

Did You Know?

Over half of Canadians believe retiring comfortably is their most important investing goal

Source: RBC 2023 Financial Independence Poll

Additional Resources

First Home Savings Account (FSHA)

Save for your first home, tax-free

A simple way to manage your day to day spending

Stay connected to your money and get help reaching your goals

Learn how personal bankruptcy works in Canada, who is eligible, and explore alternatives like consumer proposals. Get answers to the top 10 questions.

Don't know if you need a chequing account, a savings account, or both? We explain the difference and help match you with the right account.

Nearly half of young Canadians live with parents, learn how families can thrive together.

Did You Know?

44% of Canadians were not prepared for the impact of inflation

Source: RBC 2023 Financial Independence Poll

Most Popular

-

What’s a good credit score and how do you get one?

Establishing a strong credit score is the cornerstone of financial wellbeing. Explore the factors that contribute to building good credit score and why it matters to your financial future.

-

6 Ways to Rebuild Your Credit Score

If your credit score is suffering due to missed payments, or mounting bills and debt, there are steps you can take to get back on track.

-

An Alternative to Bankruptcy: Understanding the Consumer Proposal Process in Canada

Consumer proposals are an alternative to declaring bankruptcy that may be worth considering. Here is how they work.

Which of the following Cyber Security issues do you struggle with the most?

- Remembering passwords (46.53%)

- Recognizing phishing attempts (9.06%)

- Keeping devices secure from hackers (19.91%)

- Staying up to date with security practices (0%)

Struggling with debt? Learn how to pay off debt faster with repayment strategies, consolidation options and expert tips to build a debt-free future.

Considering a consumer proposal or bankruptcy to deal with debt? Here are the main benefits — and challenges — to know for each one.

Consumer proposals are an alternative to declaring bankruptcy that may be worth considering. Here is how they work.

Did You Know?

67% of Canadians are concerned about their cash flow

Source: RBC 2023 Financial Independence Poll

Tools & Calculators

See How Much You Could Save in a Registered Retirement Savings Plan

Quickly See What Your Mortgage Payments Might Look Like

Estimate the cost to buy and own an electric vehicle in Canada, compared to a gas model.

Ideas & Voices

The cash back and rewards you earn on everyday spending with loyalty programs and credit cards can really add up.

A major life change doesn’t have to be a set back – it can be powerful, positive and rejuvenating. Here’s how to navigate it all with…

Financial stress can be overwhelming, but these seven coping strategies will help you get your money – and your mind – back on track.

Did You Know?

54% of Canadians are paying more attention to their day-to-day living expenses

Source: RBC 2023 Financial Independence Poll

Additional Resources

First Home Savings Account (FHSA)

Save for your first home, tax-free

A simple way to manage your day to day spending

Stay connected to your money and get help reaching your goals

Planning to buy your first home in Canada? There’s more to it than mortgages and down payments. Learn about hidden costs and investment strategies…

Talking to elderly relatives about finances can feel awkward and emotional. Learn when to start the conversation, what to discuss and how to approach…

Latest update: The Bank of Canada holds its interest rate at 2.25%.

Did You Know?

44% of Canadians were not prepared for the impact of inflation

Source: RBC 2023 Financial Independence Poll

Most Popular

-

Bank of Canada Interest Rate Explained and How It Shapes Your Mortgage

Latest update: The Bank of Canada holds its interest rate at 2.25%.

-

How Much Do You Really Need to Retire Comfortably in Canada? Debunking the Million Dollar Myth

How much do you need to retire? The million-dollar myth is out. Instead, focus on your individual needs to determine your savings goal.

-

A guide to Understanding Your Employee Benefits

From health coverage to wellness perks and retirement savings plans, discover what may be included in your employee benefits package

Which of the following Cyber Security issues do you struggle with the most?

- Remembering passwords (46.53%)

- Recognizing phishing attempts (9.06%)

- Keeping devices secure from hackers (19.91%)

- Staying up to date with security practices (0%)

How much do you need to retire? The million-dollar myth is out. Instead, focus on your individual needs to determine your savings goal.

Manufactured homes offer a range of benefits for Canadians. Discover what makes them so appealing – and how they could help more buyers access…

If you're shopping for gifts online this season, here are some guidelines for cyber-safe holiday browsing and buying.

Did You Know?

67% of Canadians are concerned about their cash flow

Source: RBC 2023 Financial Independence Poll

Tools & Calculators

See How Much You Could Save in a Registered Retirement Savings Plan

Quickly See What Your Mortgage Payments Might Look Like

Estimate the cost to buy and own an electric vehicle in Canada, compared to a gas model.

Ideas & Voices

Since 2009, the National Association of Realtors® (NAR) has conducted an annual survey to measure the volume of U.S. residential real estate…

Learn the benefits of early mortgage renewal, especially in an uncertain economy.

Under 30 and looking to buy your first home? The right savings habits and a smart plan could bring your goal within reach faster.

Did You Know?

Over half of Canadians believe retiring comfortably is their most important investing goal

Source: RBC 2023 Financial Independence Poll

Additional Resources

First Home Savings Account (FHSA)

Save for your first home, tax-free

A simple way to manage your day to day spending

Stay connected to your money and get help reaching your goals

Discover practical ways Canadian parents can teach kids and teens about money. From first bank accounts to investing basics, help your children build…

Raising a child comes with real costs, but fewer surprises when you know what to expect. See how the numbers break down by age and how smart planning…

Caring for aging parents or relatives can strain your finances. Learn how to manage the cost of caring for elderly relatives, from budgeting to…

Did You Know?

44% of Canadians were not prepared for the impact of inflation

Source: RBC 2023 Financial Independence Poll

Most Popular

-

What is a credit card cash advance rate — and how does it work?

If you're short on cash, a credit card cash advance can be a great option to afford a purchase. Here's your guide to all things cash advance rates and how they work.

-

The Cost of Raising a Child in Canada: What to Expect at Every Stage

Raising a child comes with real costs, but fewer surprises when you know what to expect. See how the numbers break down by age and how smart planning can make family finances more manageable.

-

What is an RESP and how does it work?: Key things you need to know about this popular savings tool

The Registered Education Savings Plan (RESP) helps you save for a child's education after high school. Open an account to grow your savings tax-free.

Which of the following Cyber Security issues do you struggle with the most?

- Remembering passwords (46.53%)

- Recognizing phishing attempts (9.06%)

- Keeping devices secure from hackers (19.91%)

- Staying up to date with security practices (0%)

Nearly half of young Canadians live with parents, learn how families can thrive together.

Learn how to create, manage and fund your wedding budget so you can plan for wedding bliss—not wedding debt.

Your essential guide to separating assets, updating accounts and financial planning after divorce.

Did You Know?

67% of Canadians are concerned about their cash flow

Source: RBC 2023 Financial Independence Poll

Tools & Calculators

See How Much You Could Save in a Registered Retirement Savings Plan

Quickly See What Your Mortgage Payments Might Look Like

Estimate the cost to buy and own an electric vehicle in Canada, compared to a gas model.

Ideas & Voices

Since 2009, the National Association of Realtors® (NAR) has conducted an annual survey to measure the volume of U.S. residential real estate…

Learn the benefits of early mortgage renewal, especially in an uncertain economy.

Under 30 and looking to buy your first home? The right savings habits and a smart plan could bring your goal within reach faster.

Did You Know?

54% of Canadians are paying more attention to their day-to-day living expenses

Source: RBC 2023 Financial Independence Poll

Additional Resources

First Home Savings Account (FHSA)

Save for your first home, tax-free

A simple way to manage your day to day spending

Stay connected to your money and get help reaching your goals

Canadian businesses have been getting messages that appear to be from trusted sources, but are actually from fraudsters.

In today’s digital world, scammers increasingly leverage social engineering to craft highly personalized cyber attacks. Discover how to recognize…

This guide offers an overview of tax-free savings accounts (TFSAs) and how they work. Learn the benefits of having a TFSA, the ins and outs of…

Did You Know?

44% of Canadians were not prepared for the impact of inflation

Source: RBC 2023 Financial Independence Poll

Most Popular

-

Bank of Canada Interest Rate Explained and How It Shapes Your Mortgage

Latest update: The Bank of Canada holds its interest rate at 2.25%.

-

Should You Increase Your Credit Card Limit?

Learn everything you need to know before you increase your credit limit, including the pros and cons, and how to do it.

-

How do airport lounge passes work with credit cards?

With the right credit card, you could relax in a lounge before your flight—for free

Which of the following Cyber Security issues do you struggle with the most?

- Remembering passwords (46.53%)

- Recognizing phishing attempts (9.06%)

- Keeping devices secure from hackers (19.91%)

- Staying up to date with security practices (0%)

Whether you just made the decision to study in Canada or you’re already here, an international student bank account can help you manage your daily…

Here are some helpful questions and answers to get you started as you compare savings accounts.

Learn how CDIC (Canadian Deposit Insurance Corporation) works, what accounts it protects, how much it covers and how to maximize your coverage.

Did You Know?

67% of Canadians are concerned about their cash flow

Source: RBC 2023 Financial Independence Poll

Tools & Calculators

See How Much You Could Save in a Registered Retirement Savings Plan

Quickly See What Your Mortgage Payments Might Look Like

Estimate the cost to buy and own an electric vehicle in Canada, compared to a gas model.

Ideas & Voices

Buy Now, Pay Later (BNPL) is a popular payment option if you’re looking to spread out the cost of your purchases. Learn how it works, the risks and…

Here are 5 tips to help you kick off the year with stronger data privacy.

Seniors are often targets of financial fraud. Follow these 4 steps to protect your parents and other seniors from cyber scams and being defrauded.

Did You Know?

54% of Canadians are paying more attention to their day-to-day living expenses

Source: RBC 2023 Financial Independence Poll

Additional Resources

First Home Savings Account (FHSA)

Save for your first home, tax-free

A simple way to manage your day to day spending

Stay connected to your money and get help reaching your goals

Prioritize actions that will protect your business in the transition to a low-carbon economy.

Canadian businesses have been getting messages that appear to be from trusted sources, but are actually from fraudsters.

At Canada Climate Week Xchange, RBC and Carbonhound convened food system leaders to explore how Canada can strengthen its global competitiveness.

Did You Know?

44% of Canadians were not prepared for the impact of inflation

Source: RBC 2023 Financial Independence Poll

Most Popular

-

Don’t Panic: 4 Tax Filing Tips for Freelancers, Solopreneurs and Self-Employed

Keep up with your income tax responsibilities as your business evolves

-

Learn How the Canada Small Business Financing Program Can Help Grow Your Business

The CSBF program helps business owners access financing to start and grow their businesses. Here are answers to the top questions about CSBF.

Which of the following Cyber Security issues do you struggle with the most?

- Remembering passwords (46.53%)

- Recognizing phishing attempts (9.06%)

- Keeping devices secure from hackers (19.91%)

- Staying up to date with security practices (0%)

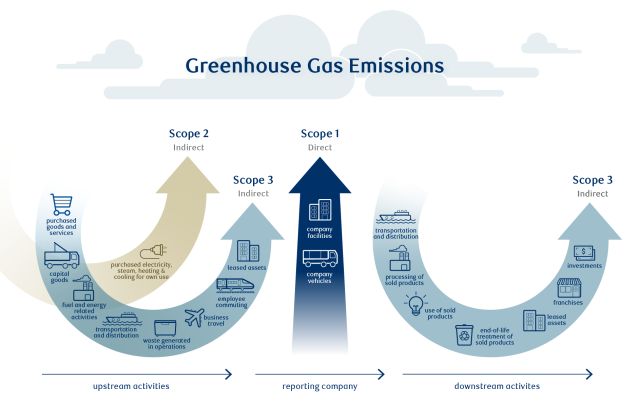

Advice for mapping the full lifecycle of business operations as part of an environmental sustainability strategy.

Government grants exist to encourage investment and innovation – but the landscape can be complex. This recap breaks down how to navigate it.

Did You Know?

67% of Canadians are concerned about their cash flow

Source: RBC 2023 Financial Independence Poll

Tools & Calculators

See How Much You Could Save in a Registered Retirement Savings Plan

Quickly See What Your Mortgage Payments Might Look Like

Estimate the cost to buy and own an electric vehicle in Canada, compared to a gas model

Ideas & Voices

The Government of Canada has recently unveiled funding strategies to help Canadian businesses affected by tariffs. Learn about the program details,…

Learn how to categorize greenhouse gas emissions and develop a framework to reduce your environmental impact

Did You Know?

54% of Canadians are paying more attention to their day-to-day living expenses

Source: RBC 2023 Financial Independence Poll

Additional Resources

First Home Savings Account (FSHA)

Save for your first home, tax-free

A simple way to manage your day to day spending

Stay connected to your money and get help reaching your goals

Get all the info you need about Registered Retirement Savings Plan (RRSP) contributions before the upcoming deadline.

This guide offers an overview of tax-free savings accounts (TFSAs) and how they work. Learn the benefits of having a TFSA, the ins and outs of…

This guide will walk you through five key steps on how to assess your financial health and prepare yourself for success in 2026 and beyond.

Did You Know?

44% of Canadians were not prepared for the impact of inflation

Source: RBC 2023 Financial Independence Poll

Most Popular

-

RRSP Contribution Deadline & Limits Guide

Get all the info you need about Registered Retirement Savings Plan (RRSP) contributions before the upcoming deadline.

-

What Tax Slips Do I Need and Where Can I Find Them?

Ensure that you're prepared with all the tax slips you need to fill out your tax return and meet the April 30 tax filing deadline.

-

In the intricate dance of managing finances as a couple, optimizing your retirement savings becomes one of the key dance steps. One sometimes helpful move is a Spousal Registered Retirement Savings Plan (Spousal RRSP), which can offer some financial and tax benefits for couples.

Which of the following Cyber Security issues do you struggle with the most?

- Remembering passwords (46.53%)

- Recognizing phishing attempts (9.06%)

- Keeping devices secure from hackers (19.91%)

- Staying up to date with security practices (0%)

Asking yourself these three questions about your goals, tax considerations and contribution room can help you make the right decision.

Canadians now have three major registered investments accounts to choose from. Here’s how to determine which ones best meet your needs.

The Canadian government has introduced a new registered account aimed at first-time homebuyers. Here's what to know about it.

Did You Know?

67% of Canadians are concerned about their cash flow

Source: RBC 2023 Financial Independence Poll

Tools & Calculators

See How Much You Could Save in a Registered Retirement Savings Plan

Quickly See What Your Mortgage Payments Might Look Like

Estimate the cost to buy and own an electric vehicle in Canada, compared to a gas model

Ideas & Voices

Why investors should focus on their long-term goals during times of market volatility.

It’s never too late to start investing. Oorbee shares how consistently working hands-on with an RBC advisor helps her build a secure financial…

How to choose a financial advisor that’s right for you

Did You Know?

54% of Canadians are paying more attention to their day-to-day living expenses

Source: RBC 2023 Financial Independence Poll

Additional Resources

First Home Savings Account (FSHA)

Save for your first home, tax-free

A simple way to manage your day to day spending

Stay connected to your money and get help reaching your goals

Money Academy

Learn the basics about budgeting, investing & borrowing, and how interest rates and inflation impact your bottom line.