Published May 30, 2024 • 8 Min Read

For newcomers, buying a home in Canada often tops the list of things they’d like to achieve when settling into their adoptive home. Homeownership brings a sense of stability, allowing newcomers to build wealth, contribute to their communities and feel a sense of belonging in a new country.

But the homebuying process can be daunting, as you navigate a housing market and financing system that can be very different from your home country. In addition to high real estate prices, it’s common to encounter additional barriers due to lack of Canadian credit history, employment in Canada or familiarity with Canadian-specific processes.

The good news is there are various resources newcomers can tap into to make the homebuying process easier. From building a thorough financial plan to consulting with a real estate agent, here’s a step-by-step guide on how you can buy your first home as a newcomer in Canada.

Check if you’re eligible to buy a home

First, it’s important to find out if you’re eligible for homeownership in Canada. To combat the country’s housing shortage, the Canadian government recently introduced the Prohibition on the Purchase of Residential Property by Non-Canadians Act, which places restrictions on non-Canadians buying a home. However, there are exceptions to these restrictions, as well as a timeline that prospective non-Canadian buyers can work on to ensure they’re on the right path to eligibility.

To fully understand how the Act impacts your buying journey, you may want to speak with a lawyer or notary to confirm your eligibility before you begin house-hunting. You can also check out the government’s homebuying regulations on your own.

Plan your finances early on

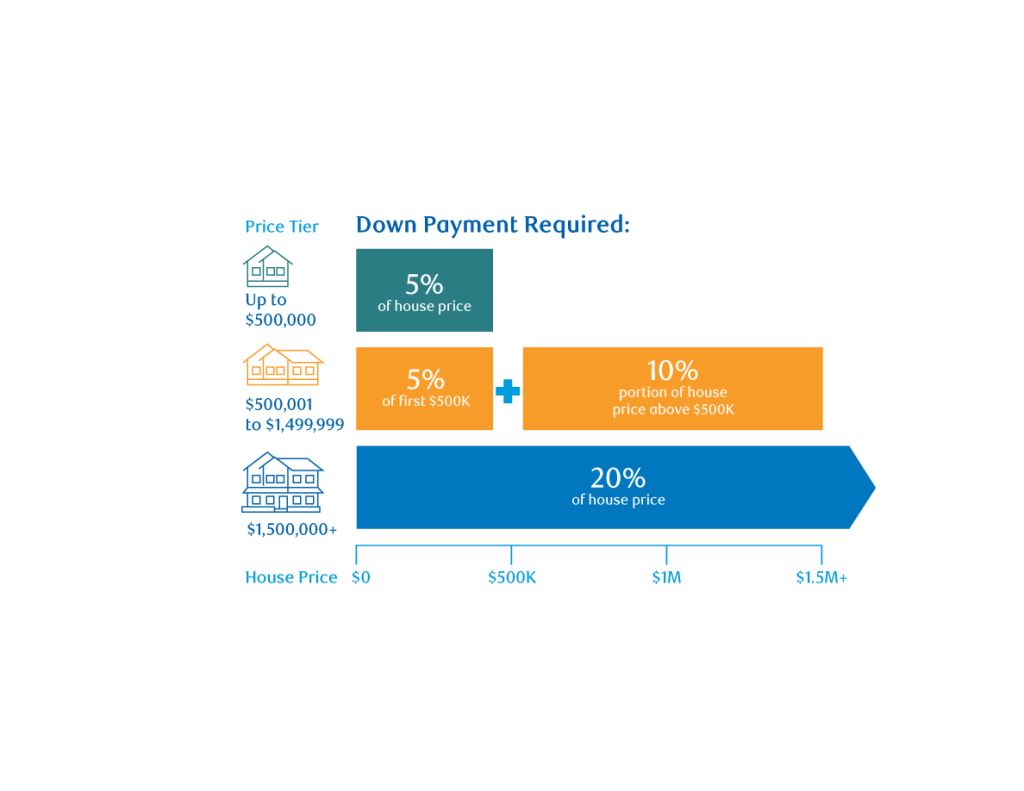

Your down payment is often the biggest expense you have when deciding to buy a new house, condominium or apartment. The larger your down payment is, the lower your mortgage payments are. If you don’t have enough funds saved from your home country, you can look at various available savings and investment accounts, which can help you save the amount you need for the down payment.

The minimum down payment you need to pay to secure a mortgage depends on the price of the home you intend to buy. If the price of the home is under $500,000 then only 5% is required; if it’s over $500,000 but under $1,499,000 then it’s 5% of the first $500,000 and 10% of the remaining amount; and if the home costs more than $1,500,000, you’ll need to pay at least 20% as a down payment.

You can research the neighbourhoods where you’d like to purchase a home, checking the average home price to determine your down payment.

Work with a financial advisor to build a savings plan for your down payment, leveraging savings and investment options that make sense for you.

It’s important to note that, along with the purchase price of your home, there will be additional costs to consider, like land transfer taxes, home inspection fees, a broker fee (if you’re using one) and closing fees, among others. You may also need to plan for maintenance costs and property taxes, so be sure to build all these costs into your financial plan.

Consult a mortgage specialist

Usually, to get a home mortgage in Canada, you need a strong credit score, which newcomers often lack because they don’t have Canadian credit history. But some banks offer newcomer-specific mortgage options — like RBC’s newcomer mortgage program — which can factor in overseas income or Canadian employment status. These programs may make you eligible for a mortgage, even if you don’t have a Canadian credit score yet.

Speak with a mortgage specialist who can help you understand how much you’re eligible to borrow, which mortgage programs you qualify for, interest rates that best suit your financial circumstances and other valuable home buying information, such as negotiating loan terms.

Before beginning your home search, it’s usually a good idea to get a mortgage pre-approval from a bank. Not only will this give you a clear idea of what your maximum budget is for your home, but it’s often a requirement to work with real estate agents. A mortgage pre-approval gives them the confidence to show you homes that are within your price range.

Research your dream home

Finding a home you love can be a fun adventure, but you’ll need to determine a few important factors. While budget may be one of your main determining factors, you will also want to factor in lifestyle preferences, your family’s needs, location, and community. Be sure to identify your home must-haves versus your nice-to-haves, so you’ll be ready to make a sound decision when viewing the homes you’re interested in.

If you can, it’s good idea to consult with friends or colleagues who have gone through the experience of buying their first home and may be able to advise you on what to consider when looking at houses. They might also refer you to trusted real estate agents who offer services aligned with your needs and aren’t pushy about closing on the first home you like. You can also use platforms like Houseful, which provides tools, resources and expertise to help you find your dream home, and can also connect you with trusted real estate agents in the area you are interested in.

Hire a real estate professional

Buying a home for the first time in a new country can be overwhelming. Experts like realtors and mortgage brokers can guide you through the entire house-hunting process. The right real estate agent will take the time to understand you and your needs before recommending listings. A good agent will be able to spot potential issues (like signs of termites, or an aging roof) that you might miss on your own and can help find hidden cost-savers like unfinished basements or expensive repairs. If you have a language barrier, you may want to hire a real estate agent who is fluent in your mother tongue and can assist you in negotiating better yourself.

Real estate agents can guide you through large amounts of paperwork and keep you up to date with the housing market’s rules and regulations. Their team might include attorneys, home inspectors and other professionals who will also make the home-buying process easier for you.

Make an offer

Once you’ve been pre-approved for a mortgage on your dream home, it’s time to make an offer. In today’s competitive real estate market, it’s possible your offer may be rejected, and you might be able to back to the negotiating table and discuss new terms. You may also find yourself in a bidding war — if there is lots of interest from other home buyers, you may have to increase your offer to seal the deal. Keep an eye on your budget and consider how much of an increase you can afford if you really want to buy a particular home.

Schedule your home inspection

If your offer is accepted but is conditional on a home inspection, you will have to wait till after the home inspector completes his inspection. If major structural issues are uncovered with the home, you may renegotiate the price.

You’ll also need to conduct a home appraisal, which confirms you’re getting a fair market value, as well as a land survey, which confirms the boundaries of your property and helps you avoid any future disputes.

Set your closing date

Once your offer has been accepted by the seller, get ready to close the transaction. You’ll need to submit your deposit, which shows your commitment to the transaction. Then your lawyer and real estate agent will ensure you sign all the necessary legal documents related to your home purchase. You’ll also set your closing date, which is when you sign all your final paperwork and the seller transfers the property’s deed to you, handing you the keys to your new home.

Prepare for additional costs

It’s important to keep in mind that there will be closing costs, including an attorney fee, appraiser fee, home inspection fee and the costs for the title search and insurance. This is to make sure that there are no legal issues attached to your property. In some cases, you may need to pay property taxes and homeowners’ insurance in advance.

Shopping around for your home insurance is an important step, so you may want to compare quotes from multiple insurance companies. Look for a policy that has good coverage for damage. Your lender will ask you for proof of insurance before finalizing the mortgage, so this step is mandatory. Make sure you review your loan estimate and closing disclosure documents to understand all the costs connected to your purchase.

Plant your roots in Canada

Buying your first home in Canada can be an overwhelming process, but it doesn’t need to be stressful. Begin by making your financial plan, and when you have sufficient funds for a down payment, get pre-approved for a mortgage and work with a trustworthy real estate professional to guide you through the process. With the right support, you can become a homeowner in Canada.

This article is intended as general information only and is not to be relied upon as constituting legal, financial or other professional advice. A professional advisor should be consulted regarding your specific situation. Information presented is believed to be factual and up-to-date but we do not guarantee its accuracy and it should not be regarded as a complete analysis of the subjects discussed. All expressions of opinion reflect the judgment of the authors as of the date of publication and are subject to change. No endorsement of any third parties or their advice, opinions, information, products or services is expressly given or implied by Royal Bank of Canada or any of its affiliates.

Share This Article