Published February 2, 2024 • 7 Min Read

Exciting is not typically a word used to describe bonds or fixed income overall. But in 2024, that appears to be changing.

“We’ve come through one of the most devastating bear markets for bonds we’ve ever seen. Maybe the worst we’ve ever seen because we were at 150-year lows for interest rates,” says Dan Chornous, Chief Investment Officer at RBC Global Asset Management. “But there’s been a tremendous alignment of factors that have pushed the bond market forward,” he added during an episode of The Download podcast.

One of the biggest factors? Inflation has come down considerably.

Following strong fixed-income markets in November, investors welcomed U.S. Federal Reserve Chairman Jerome Powell’s mid-December guidance that the aggressive rate hikes that had been happening since early 2022 were now over. Powell also suggested rate cuts starting in 2024 may be appropriate as inflation continues on the path to more normal levels. In Canada, many economists are also predicting the Bank of Canada will cut rates sometime this year.

According to Chornous, while it may still take 12 to 18 months to reach the 2 per cent inflation target, the Federal Reserve’s comments suggest they believe the steps they have taken will accomplish their goal of bringing inflation back to normal levels.

Why does that matter for fixed-income investors and what might it mean for your portfolio this year?

As Chornous points out in a paper titled Rate Cycle Maturing, “with yields now well within their normal range of the past 150 years, bonds’ utility in portfolio construction is again evident.”

Bonds have traditionally played a highly useful role in portfolios, limiting downside through interest payments and often moving in the opposite direction to stocks, which can help temper portfolio volatility, he notes. (Check out Bond basics: A Primer for a simple breakdown of how bonds work.)

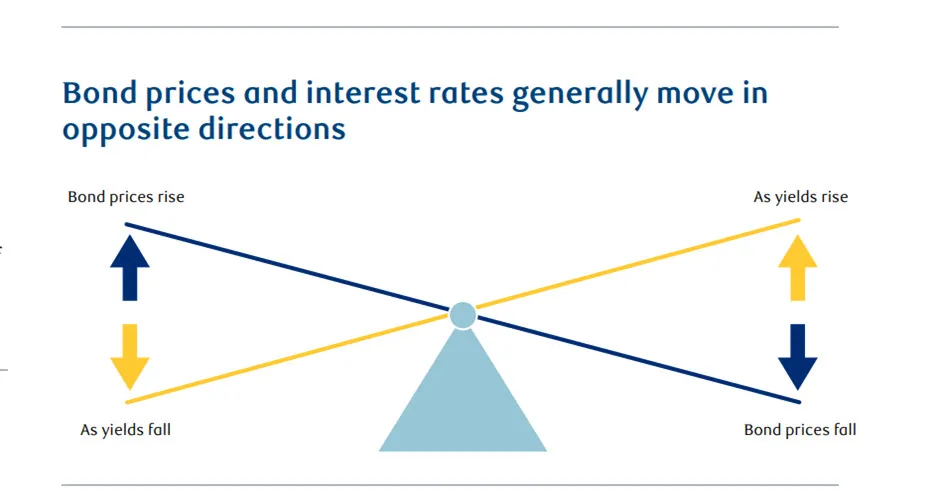

Bond prices have an inverse relationship to interest rates, so when interest rates go up, the prices of bonds go down, and when interest rates go down, which is what many economists are predicting in the months ahead, prices go up. In addition to providing a predictable source of income, bonds can also help balance risk and protect a portfolio when stock markets are moving downwards.

Ultimately, holding bonds in a portfolio can help with diversification. Often, portfolio solutions (investments made up of carefully selected and managed mutual funds and/or exchange-traded funds) will include a fixed income component depending on how much risk you’re comfortable with or when you will need your money. Learn more about portfolio solutions at RBC here.

With investors holding record amounts of cash and cash-like instruments in their portfolios following uncertainties surrounding the pandemic and a spike in short-term interest rates, many are now looking to deploy that cash.

“Those that have built cash and short-term investments above the ‘normal’ levels embedded in their investment plans should consider a path to restoring balance in their portfolios…Fortunately bonds,” Chornous notes, “now offer better income, valuations and benefits to portfolio dynamics than they have in 15 years.”

Dagmara Fijalkowski, Head of Global Fixed Income and Currencies at RBC Global Asset Management, agrees.

“We believe that the major valuation risk for bonds is now mostly behind us. Even with the recent rally, bonds are the most attractive they’ve been in decades,” she wrote in a January report. She notes that historically, the period following the last rate hike has been a favourable environment for bonds.

Just how do fixed-income investments like bonds play into a diversified portfolio? Some of the key benefits include:

Income: Most bonds pay interest semi-annually; however, some bonds pay monthly, quarterly or even on an annual basis. These payments provide you with regular and predictable income. This regular income stream can also help to reduce the volatility of your portfolio’s returns.

Variety: Many kinds of fixed-income products are available, such as guaranteed investment certificates (GICs), fixed income mutual funds, exchange-traded funds, treasury bills and government, provincial and corporate bonds. Strip bonds, real return bonds, step-up bonds, Eurobonds and many U.S. instruments are also available.

Some Terms You Need To Know

- Face value/Par value: The amount of the original loan.

- Coupon: The interest rate that applies to the loan.

- Term: The length of time the loan lasts. The term can be anywhere from a year or less to as long as 30 years.

- Maturity date: The date the bond becomes due and the issuer must repay the loan.

- Current Yield: A simple measure that calculates the annual income generated by a bond as a percentage of its current market price. It can be useful for investors with a shorter time horizon. However, it does not consider factors such as time to maturity and potential price changes.

- Yield-to-maturity: A more comprehensive measure that estimates the total return an investor can expect to earn if a bond is held until its maturity date. It considers both the bond’s periodic coupon payments and any capital gains or losses upon

- maturity. For the purposes of this article, we focus on yield-to-maturity as it provides a more complete picture of a bond’s return potential.

- Duration: A way to measure how sensitive bonds are to changes in interest rates. It is expressed as a number of years because it’s a calculation of how long it will take the investor to be paid back on their loan in full. The further away a bond is from its maturity date, the longer its duration usually is – meaning it is more exposed to changing interest rates.

When you buy fixed income, you are lending your money to the issuer. Essentially, a fixed income product is like an IOU given by the issuer to investors. These IOUs can be issued by governments and corporations. In return for lending the money, you get a benefit – most commonly in the form of regular interest payments until the money is repaid. There are many different kinds of fixed income products, though bonds are probably the best known.

Are bonds right for you? Email your Financial Planner or sign in and book an appointment through MyAdvisor or RBC Online Banking.

To check out ways to invest at RBC, visit rbc.com/investments.

Mutual Funds are sold by Royal Mutual Funds Inc. (RMFI). There may be commissions, trailing commissions, management fees and expenses associated with mutual fund investments. Please read the Fund Facts/prospectus before investing. Mutual fund securities are not insured by the Canada Deposit Insurance Corporation. For funds other than money market funds, unit values change frequently. For money market funds, there can be no assurances that a fund will be able to maintain its net asset value per security at a constant amount or that the full amount of your investment in a fund will be returned to you. Past performance may not be repeated. RMFI is licensed as a financial services firm in the province of Quebec.

Investment advice is provided by Royal Mutual Funds Inc. (RMFI). RMFI, RBC Global Asset Management Inc., Royal Bank of Canada, Royal Trust Corporation of Canada and The Royal Trust Company are separate corporate entities which are affiliated. RMFI is licensed as a financial services firm in the province of Quebec.

This article is intended as general information only and is not to be relied upon as constituting legal, financial or other professional advice. A professional advisor should be consulted regarding your specific situation. Information presented is believed to be factual and up-to-date but we do not guarantee its accuracy and it should not be regarded as a complete analysis of the subjects discussed. All expressions of opinion reflect the judgment of the authors as of the date of publication and are subject to change. No endorsement of any third parties or their advice, opinions, information, products or services is expressly given or implied by Royal Bank of Canada or any of its affiliates.

Share This Article