What Matters Now

What’s On Your Mind?

Latest Articles

Canadians have a lot of misconceptions about how credit scores work, from how they’re calculated to what makes them go up or down. We debunk 5…

Parents can empower their kids to explore the digital world safely by using the right tools and setting healthy boundaries. Here’s how.

New to Canada? Learn how loyalty rewards credit cards work, why they matter, how they can help you earn rewards and build credit as you build your new…

Did You Know?

44% of Canadians were not prepared for the impact of inflation

Source: RBC 2023 Financial Independence Poll

Most Popular

-

How Horizon Grains Realized Exponential Growth by Expanding to New Markets

With the help of the right resources and expertise, Horizon Grains Canada increased their revenue by 1150% in 6 years by expanding to new global markets.

-

How Duer Brought the World’s Most Comfortable Pants to a Global Market

Gary Lenett's path to a global business began from the bike lane. Learn how he launched Duer and took it to over two dozen countries.

-

Bank of Canada Interest Rate Explained and How It Shapes Your Mortgage

The Bank of Canada announcement: interest rates are holding steady. Learn how you could benefit from buying a pre-construction home

Which of the following Cyber Security issues do you struggle with the most?

- Remembering passwords (43.05%)

- Recognizing phishing attempts (9.27%)

- Keeping devices secure from hackers (20.70%)

- Staying up to date with security practices (0%)

Your money matters. It matters to you, your quality of life, your family and your overall well-being. Now that you're here, explore the many facets of…

Getting payroll wrong can cost you – from government fines to audits to unhappy employees. Learn how the right processes can make payroll…

Explore the real stories behind Canadian businesses — from getting started to scaling up—and the turning points that made it happen.

Did You Know?

67% of Canadians are concerned about their cash flow

Source: RBC 2023 Financial Independence Poll

Tools & Calculators

See How Much You Could Save in a Registered Retirement Savings Plan

Quickly See What Your Mortgage Payments Might Look Like

Estimate the cost to buy and own an electric vehicle in Canada, compared to a gas model.

Ideas & Voices

: Investing can feel daunting — but it doesn’t have to be. Here’s how one Canadian used investing to reach her financial goals.

Your business credit card comes with perks that can help you save money and run your business better. Get to know the benefits so you don’t miss…

Bev Betteridge has grown The Corner Office by focusing on technology-based, end-to-end solutions for her clients

Did You Know?

Over half of Canadians believe retiring comfortably is their most important investing goal

Source: RBC 2023 Financial Independence Poll

Additional Resources

First Home Savings Account (FSHA)

Save for your first home, tax-free

A simple way to manage your day to day spending

Stay connected to your money and get help reaching your goals

Canadians have a lot of misconceptions about how credit scores work, from how they’re calculated to what makes them go up or down. We debunk 5…

When money worries weigh you down, bottling those feelings up can make them an even heavier burden. Here’s how talking about them can improve your…

Master your post-grad finances with this essential guide to help you navigate student debt and building a solid financial foundation in Canada.

Did You Know?

44% of Canadians were not prepared for the impact of inflation

Source: RBC 2023 Financial Independence Poll

Most Popular

-

5 Myths about Your Credit Score

Canadians have a lot of misconceptions about how credit scores work, from how they’re calculated to what makes them go up or down. We debunk 5 common credit score myths so you can improve your financial health.

-

How to Maintain a Strong Credit Score During Challenging Times

While credit can act as a financial safety net during tight times, it’s important to maintain a strong credit score in the meantime. Here’s why – and how.

-

5 Tips to Help Keep Your Credit Score in Good Standing

Keeping a healthy credit score is about more than just watching what you spend. Follow these tips to help keep your score credit-worthy.

Which of the following Cyber Security issues do you struggle with the most?

- Remembering passwords (43.05%)

- Recognizing phishing attempts (9.27%)

- Keeping devices secure from hackers (20.70%)

- Staying up to date with security practices (0%)

Financial secrets can derail a relationship. Learning how to address them can rebuild trust.

The cash back and rewards you earn on everyday spending with loyalty programs and credit cards can really add up.

A major life change doesn’t have to be a set back – it can be powerful, positive and rejuvenating. Here’s how to navigate it all with…

Did You Know?

67% of Canadians are concerned about their cash flow

Source: RBC 2023 Financial Independence Poll

Tools & Calculators

See How Much You Could Save in a Registered Retirement Savings Plan

Quickly See What Your Mortgage Payments Might Look Like

Estimate the cost to buy and own an electric vehicle in Canada, compared to a gas model.

Ideas & Voices

Did You Know?

54% of Canadians are paying more attention to their day-to-day living expenses

Source: RBC 2023 Financial Independence Poll

Additional Resources

First Home Savings Account (FHSA)

Save for your first home, tax-free

A simple way to manage your day to day spending

Stay connected to your money and get help reaching your goals

Since 2009, the National Association of Realtors® (NAR) has conducted an annual survey to measure the volume of U.S. residential real estate…

The Bank of Canada announcement: interest rates are holding steady. Learn how you could benefit from buying a pre-construction home

Learn the benefits of early mortgage renewal, especially in an uncertain economy.

Did You Know?

44% of Canadians were not prepared for the impact of inflation

Source: RBC 2023 Financial Independence Poll

Most Popular

-

Bank of Canada Interest Rate Explained and How It Shapes Your Mortgage

The Bank of Canada announcement: interest rates are holding steady. Learn how you could benefit from buying a pre-construction home

-

The Million Dollar Retirement Myth: What Does It Really Take to Retire Today?

How much do you need to retire? The million-dollar myth is out. Instead, focus on your individual needs to determine your savings goal.

-

Can I Unlock My Locked-In Retirement Funds? Understanding Your Options

If you have funds in a locked-in retirement account, you may be wondering if and how you can unlock the account to access your funds.

Which of the following Cyber Security issues do you struggle with the most?

- Remembering passwords (43.05%)

- Recognizing phishing attempts (9.27%)

- Keeping devices secure from hackers (20.70%)

- Staying up to date with security practices (0%)

Under 30 and looking to buy your first home? The right savings habits and a smart plan could bring your goal within reach faster.

Explore the top travel destinations in Canada you can enjoy without breaking the bank.

Learn how to earn, redeem, and maximize your travel points.

Did You Know?

67% of Canadians are concerned about their cash flow

Source: RBC 2023 Financial Independence Poll

Tools & Calculators

See How Much You Could Save in a Registered Retirement Savings Plan

Quickly See What Your Mortgage Payments Might Look Like

Estimate the cost to buy and own an electric vehicle in Canada, compared to a gas model.

Ideas & Voices

How to make an offer sellers can't refuse.

You know the benefits of owning a home. You've probably been through the home-buying process once or twice. Now is the time to share your experiences.

Depending on your province, homeowners can access a variety of federal and provincial heat pump rebates and grants.

Did You Know?

Over half of Canadians believe retiring comfortably is their most important investing goal

Source: RBC 2023 Financial Independence Poll

Additional Resources

First Home Savings Account (FHSA)

Save for your first home, tax-free

A simple way to manage your day to day spending

Stay connected to your money and get help reaching your goals

Parents can empower their kids to explore the digital world safely by using the right tools and setting healthy boundaries. Here’s how.

New to Canada? Learn how loyalty rewards credit cards work, why they matter, how they can help you earn rewards and build credit as you build your new…

Building family wealth and leaving a legacy you’ll be proud of requires deliberate action across life’s different stages.

Did You Know?

44% of Canadians were not prepared for the impact of inflation

Source: RBC 2023 Financial Independence Poll

Most Popular

-

What is a credit card cash advance rate — and how does it work?

If you're short on cash, a credit card cash advance can be a great option to afford a purchase. Here's your guide to all things cash advance rates and how they work.

-

Tips for Newcomers Starting a Business in Canada

For newcomers starting a business in Canada, there can be extra challenges in the beginning. Here are some tips as you start to plan.

-

Welcome to Canada: A Checklist for Your First Year in Canada

Moving to Canada can be overwhelming, but this comprehensive checklist of all the things to do in your first year can set you up for success. Learn about essential tasks like getting a SIN, opening a bank account, finding accommodation and building your career. Welcome to your new home!

Which of the following Cyber Security issues do you struggle with the most?

- Remembering passwords (43.05%)

- Recognizing phishing attempts (9.27%)

- Keeping devices secure from hackers (20.70%)

- Staying up to date with security practices (0%)

Financial secrets can derail a relationship. Learning how to address them can rebuild trust.

Moving to a new country is full of unknowns. But help is out there for newcomers, and financial success is possible through open conversations about…

While Money is the number one thing couples fight about, love and money can co-exist! Here’s how

Did You Know?

67% of Canadians are concerned about their cash flow

Source: RBC 2023 Financial Independence Poll

Tools & Calculators

See How Much You Could Save in a Registered Retirement Savings Plan

Quickly See What Your Mortgage Payments Might Look Like

Estimate the cost to buy and own an electric vehicle in Canada, compared to a gas model.

Ideas & Voices

How to make an offer sellers can't refuse.

You know the benefits of owning a home. You've probably been through the home-buying process once or twice. Now is the time to share your experiences.

Depending on your province, homeowners can access a variety of federal and provincial heat pump rebates and grants.

Did You Know?

54% of Canadians are paying more attention to their day-to-day living expenses

Source: RBC 2023 Financial Independence Poll

Additional Resources

First Home Savings Account (FHSA)

Save for your first home, tax-free

A simple way to manage your day to day spending

Stay connected to your money and get help reaching your goals

Canadians have a lot of misconceptions about how credit scores work, from how they’re calculated to what makes them go up or down. We debunk 5…

Parents can empower their kids to explore the digital world safely by using the right tools and setting healthy boundaries. Here’s how.

Your money matters. It matters to you, your quality of life, your family and your overall well-being. Now that you're here, explore the many facets of…

Did You Know?

44% of Canadians were not prepared for the impact of inflation

Source: RBC 2023 Financial Independence Poll

Most Popular

-

Bank of Canada Interest Rate Explained and How It Shapes Your Mortgage

The Bank of Canada announcement: interest rates are holding steady. Learn how you could benefit from buying a pre-construction home

-

5 Myths about Your Credit Score

Canadians have a lot of misconceptions about how credit scores work, from how they’re calculated to what makes them go up or down. We debunk 5 common credit score myths so you can improve your financial health.

-

How to Maintain a Strong Credit Score During Challenging Times

While credit can act as a financial safety net during tight times, it’s important to maintain a strong credit score in the meantime. Here’s why – and how.

Which of the following Cyber Security issues do you struggle with the most?

- Remembering passwords (43.05%)

- Recognizing phishing attempts (9.27%)

- Keeping devices secure from hackers (20.70%)

- Staying up to date with security practices (0%)

1 in 5 businesses experienced payment fraud within the last 6 months.

The Bank of Canada announcement: interest rates are holding steady. Learn how you could benefit from buying a pre-construction home

Learn the benefits of early mortgage renewal, especially in an uncertain economy.

Did You Know?

67% of Canadians are concerned about their cash flow

Source: RBC 2023 Financial Independence Poll

Tools & Calculators

See How Much You Could Save in a Registered Retirement Savings Plan

Quickly See What Your Mortgage Payments Might Look Like

Estimate the cost to buy and own an electric vehicle in Canada, compared to a gas model.

Ideas & Voices

Like oceans, markets are always shifting. Find out why fixating on first impressions can be harmful to your investing decisions and how you can avoid…

Should you opt for credit card balance protection insurance? Here's what you need to know about the protection these policies provide, and if they…

Even in the face of challenging buying conditions, Canadians continue to purchase property in the U.S.

Did You Know?

54% of Canadians are paying more attention to their day-to-day living expenses

Source: RBC 2023 Financial Independence Poll

Additional Resources

First Home Savings Account (FHSA)

Save for your first home, tax-free

A simple way to manage your day to day spending

Stay connected to your money and get help reaching your goals

Getting payroll wrong can cost you – from government fines to audits to unhappy employees. Learn how the right processes can make payroll…

Explore the real stories behind Canadian businesses — from getting started to scaling up—and the turning points that made it happen.

A Point of Sale (POS) system does more than process payments. The right one can help streamline your business’s sales process, provide valuable…

Did You Know?

44% of Canadians were not prepared for the impact of inflation

Source: RBC 2023 Financial Independence Poll

Most Popular

-

How Horizon Grains Realized Exponential Growth by Expanding to New Markets

With the help of the right resources and expertise, Horizon Grains Canada increased their revenue by 1150% in 6 years by expanding to new global markets.

-

How Duer Brought the World’s Most Comfortable Pants to a Global Market

Gary Lenett's path to a global business began from the bike lane. Learn how he launched Duer and took it to over two dozen countries.

-

How a Weak Canadian Dollar Could Impact Businesses and Investors

Recovery could be slow, even if tariffs issues are settled, due to anticipated cuts to interest rates.

Which of the following Cyber Security issues do you struggle with the most?

- Remembering passwords (43.05%)

- Recognizing phishing attempts (9.27%)

- Keeping devices secure from hackers (20.70%)

- Staying up to date with security practices (0%)

Spend less time chasing funds and more time growing your business.

1 in 5 businesses experienced payment fraud within the last 6 months.

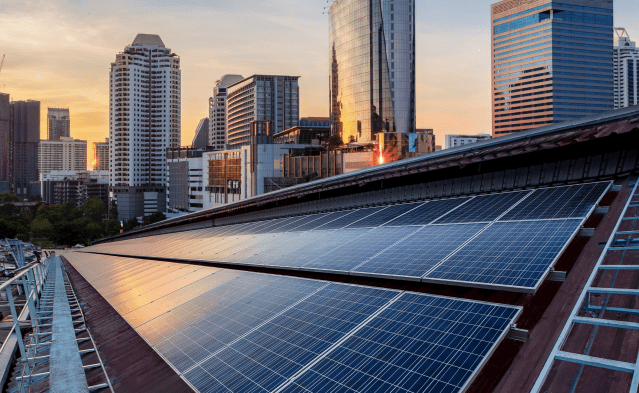

Learn about the Vancouver Greenhouse Gas and Energy Limits bylaw, what’s required from building owners and the resources available to support your…

Did You Know?

67% of Canadians are concerned about their cash flow

Source: RBC 2023 Financial Independence Poll

Tools & Calculators

See How Much You Could Save in a Registered Retirement Savings Plan

Quickly See What Your Mortgage Payments Might Look Like

Estimate the cost to buy and own an electric vehicle in Canada, compared to a gas model

Ideas & Voices

Farmers want to work with policymakers to craft sustainable agriculture policy. Here's what's needed to make that happen.

There's a disconnect between what farmers think about sustainable agriculture and the way policy is developed. Fixing it is critical.

Sustainable agriculture may best be achieved when the government works alongside farmers to do three things.

Did You Know?

54% of Canadians are paying more attention to their day-to-day living expenses

Source: RBC 2023 Financial Independence Poll

Additional Resources

First Home Savings Account (FSHA)

Save for your first home, tax-free

A simple way to manage your day to day spending

Stay connected to your money and get help reaching your goals

Building family wealth and leaving a legacy you’ll be proud of requires deliberate action across life’s different stages.

Here are 10 tips to help you save money, so you can make your financial goals a reality

A varied asset mix can help boost your portfolio during economic uncertainty

Did You Know?

44% of Canadians were not prepared for the impact of inflation

Source: RBC 2023 Financial Independence Poll

Most Popular

-

Compound Interest: How It Works and Why It’s Amazing

Find out why 'interest on interest' is important and how it can make your wealth grow faster.

-

Passive Income: How to Make Your Money Work For You

Ready to earn some passive income? Here are the basics of creating regular cash flows from investments without breaking (too much of) a sweat.

Which of the following Cyber Security issues do you struggle with the most?

- Remembering passwords (43.05%)

- Recognizing phishing attempts (9.27%)

- Keeping devices secure from hackers (20.70%)

- Staying up to date with security practices (0%)

This guide outlines the basics of investing in Canada to help you get comfortable before you invest

Here’s a quick rundown on mutual funds – how they work and why they’re popular.

Learn the differences between saving and investing and how to decide the best move for your money.

Did You Know?

67% of Canadians are concerned about their cash flow

Source: RBC 2023 Financial Independence Poll

Tools & Calculators

See How Much You Could Save in a Registered Retirement Savings Plan

Quickly See What Your Mortgage Payments Might Look Like

Estimate the cost to buy and own an electric vehicle in Canada, compared to a gas model

Ideas & Voices

Did You Know?

54% of Canadians are paying more attention to their day-to-day living expenses

Source: RBC 2023 Financial Independence Poll

Additional Resources

First Home Savings Account (FSHA)

Save for your first home, tax-free

A simple way to manage your day to day spending

Stay connected to your money and get help reaching your goals

Money Academy

Learn the basics about budgeting, investing & borrowing, and how interest rates and inflation impact your bottom line.