What Matters Now

What’s On Your Mind?

Latest Articles

Canadians have a lot of misconceptions about how credit scores work, from how they’re calculated to what makes them go up or down. We debunk 5…

Parents can empower their kids to explore the digital world safely by using the right tools and setting healthy boundaries. Here’s how.

New to Canada? Learn how loyalty rewards credit cards work, why they matter, how they can help you earn rewards and build credit as you build your new…

Did You Know?

44% of Canadians were not prepared for the impact of inflation

Source: RBC 2023 Financial Independence Poll

Most Popular

-

How Horizon Grains Realized Exponential Growth by Expanding to New Markets

With the help of the right resources and expertise, Horizon Grains Canada increased their revenue by 1150% in 6 years by expanding to new global markets.

-

How Duer Brought the World’s Most Comfortable Pants to a Global Market

Gary Lenett's path to a global business began from the bike lane. Learn how he launched Duer and took it to over two dozen countries.

-

Bank of Canada Interest Rate Explained and How It Shapes Your Mortgage

The Bank of Canada announcement: interest rates are holding steady. Learn how you could benefit from buying a pre-construction home

Which of the following Cyber Security issues do you struggle with the most?

- Remembering passwords (43.02%)

- Recognizing phishing attempts (9.30%)

- Keeping devices secure from hackers (20.60%)

- Staying up to date with security practices (0%)

Your money matters. It matters to you, your quality of life, your family and your overall well-being. Now that you're here, explore the many facets of…

Getting payroll wrong can cost you – from government fines to audits to unhappy employees. Learn how the right processes can make payroll…

Explore the real stories behind Canadian businesses — from getting started to scaling up—and the turning points that made it happen.

Did You Know?

67% of Canadians are concerned about their cash flow

Source: RBC 2023 Financial Independence Poll

Tools & Calculators

See How Much You Could Save in a Registered Retirement Savings Plan

Quickly See What Your Mortgage Payments Might Look Like

Estimate the cost to buy and own an electric vehicle in Canada, compared to a gas model.

Ideas & Voices

A list of questions you can ask during your coffee chats to build a strong network as a newcomer in Canada and improve your chances of finding a job.

If you're approaching retirement age amid this cost-of-living crunch, you'll want to consider these three steps to stay on top of your finances.

This guide will walk you through five key steps on how to assess your financial health and prepare yourself for success in 2025 and beyond.

Did You Know?

Over half of Canadians believe retiring comfortably is their most important investing goal

Source: RBC 2023 Financial Independence Poll

Additional Resources

First Home Savings Account (FSHA)

Save for your first home, tax-free

A simple way to manage your day to day spending

Stay connected to your money and get help reaching your goals

Canadians have a lot of misconceptions about how credit scores work, from how they’re calculated to what makes them go up or down. We debunk 5…

When money worries weigh you down, bottling those feelings up can make them an even heavier burden. Here’s how talking about them can improve your…

Master your post-grad finances with this essential guide to help you navigate student debt and building a solid financial foundation in Canada.

Did You Know?

44% of Canadians were not prepared for the impact of inflation

Source: RBC 2023 Financial Independence Poll

Most Popular

-

5 Myths about Your Credit Score

Canadians have a lot of misconceptions about how credit scores work, from how they’re calculated to what makes them go up or down. We debunk 5 common credit score myths so you can improve your financial health.

-

5 Tips to Help Keep Your Credit Score in Good Standing

Keeping a healthy credit score is about more than just watching what you spend. Follow these tips to help keep your score credit-worthy.

-

Personal Bankruptcy in Canada: Your Top 10 Questions Answered

Personal Bankruptcy can feel overwhelming and confusing. Find answers to your most pressing questions here.

Which of the following Cyber Security issues do you struggle with the most?

- Remembering passwords (43.02%)

- Recognizing phishing attempts (9.30%)

- Keeping devices secure from hackers (20.60%)

- Staying up to date with security practices (0%)

Financial secrets can derail a relationship. Learning how to address them can rebuild trust.

The cash back and rewards you earn on everyday spending with loyalty programs and credit cards can really add up.

A major life change doesn’t have to be a set back – it can be powerful, positive and rejuvenating. Here’s how to navigate it all with…

Did You Know?

67% of Canadians are concerned about their cash flow

Source: RBC 2023 Financial Independence Poll

Tools & Calculators

See How Much You Could Save in a Registered Retirement Savings Plan

Quickly See What Your Mortgage Payments Might Look Like

Estimate the cost to buy and own an electric vehicle in Canada, compared to a gas model.

Ideas & Voices

Did You Know?

54% of Canadians are paying more attention to their day-to-day living expenses

Source: RBC 2023 Financial Independence Poll

Additional Resources

First Home Savings Account (FHSA)

Save for your first home, tax-free

A simple way to manage your day to day spending

Stay connected to your money and get help reaching your goals

Since 2009, the National Association of Realtors® (NAR) has conducted an annual survey to measure the volume of U.S. residential real estate…

The Bank of Canada announcement: interest rates are holding steady. Learn how you could benefit from buying a pre-construction home

Learn the benefits of early mortgage renewal, especially in an uncertain economy.

Did You Know?

44% of Canadians were not prepared for the impact of inflation

Source: RBC 2023 Financial Independence Poll

Most Popular

-

Bank of Canada Interest Rate Explained and How It Shapes Your Mortgage

The Bank of Canada announcement: interest rates are holding steady. Learn how you could benefit from buying a pre-construction home

-

Can I Unlock My Locked-In Retirement Funds? Understanding Your Options

If you have funds in a locked-in retirement account, you may be wondering if and how you can unlock the account to access your funds.

-

Selling Your U.S. Property? 6 Things Canadians Need to Know

If you're preparing to sell your U.S. home, a bit of advance planning can make things easier.

Which of the following Cyber Security issues do you struggle with the most?

- Remembering passwords (43.02%)

- Recognizing phishing attempts (9.30%)

- Keeping devices secure from hackers (20.60%)

- Staying up to date with security practices (0%)

Under 30 and looking to buy your first home? The right savings habits and a smart plan could bring your goal within reach faster.

Explore the top travel destinations in Canada you can enjoy without breaking the bank.

Learn how to earn, redeem, and maximize your travel points.

Did You Know?

67% of Canadians are concerned about their cash flow

Source: RBC 2023 Financial Independence Poll

Tools & Calculators

See How Much You Could Save in a Registered Retirement Savings Plan

Quickly See What Your Mortgage Payments Might Look Like

Estimate the cost to buy and own an electric vehicle in Canada, compared to a gas model.

Ideas & Voices

Prevent unwanted surprises during auto loan negotiations by understanding your credit score and it's implications.

Find the right car for you: Four factors to consider when deciding between a new or used vehicle.

Weighing the advantages and disadvantages of ownership options for your lifestyle and finances.

Did You Know?

Over half of Canadians believe retiring comfortably is their most important investing goal

Source: RBC 2023 Financial Independence Poll

Additional Resources

First Home Savings Account (FHSA)

Save for your first home, tax-free

A simple way to manage your day to day spending

Stay connected to your money and get help reaching your goals

Parents can empower their kids to explore the digital world safely by using the right tools and setting healthy boundaries. Here’s how.

New to Canada? Learn how loyalty rewards credit cards work, why they matter, how they can help you earn rewards and build credit as you build your new…

Building family wealth and leaving a legacy you’ll be proud of requires deliberate action across life’s different stages.

Did You Know?

44% of Canadians were not prepared for the impact of inflation

Source: RBC 2023 Financial Independence Poll

Most Popular

-

What is a credit card cash advance rate — and how does it work?

If you're short on cash, a credit card cash advance can be a great option to afford a purchase. Here's your guide to all things cash advance rates and how they work.

-

Marriage and Money: Joint Bank Accounts?

You've merged your lives. Should you also merge your bank accounts?

-

Bringing Money to Canada and Sending Money Overseas as a Newcomer

Whether you’re bringing funds to Canada with you or sending money back to your loved ones, here’s how to transfer money securely.

Which of the following Cyber Security issues do you struggle with the most?

- Remembering passwords (43.02%)

- Recognizing phishing attempts (9.30%)

- Keeping devices secure from hackers (20.60%)

- Staying up to date with security practices (0%)

Financial secrets can derail a relationship. Learning how to address them can rebuild trust.

Moving to a new country is full of unknowns. But help is out there for newcomers, and financial success is possible through open conversations about…

While Money is the number one thing couples fight about, love and money can co-exist! Here’s how

Did You Know?

67% of Canadians are concerned about their cash flow

Source: RBC 2023 Financial Independence Poll

Tools & Calculators

See How Much You Could Save in a Registered Retirement Savings Plan

Quickly See What Your Mortgage Payments Might Look Like

Estimate the cost to buy and own an electric vehicle in Canada, compared to a gas model.

Ideas & Voices

Prevent unwanted surprises during auto loan negotiations by understanding your credit score and it's implications.

Find the right car for you: Four factors to consider when deciding between a new or used vehicle.

Weighing the advantages and disadvantages of ownership options for your lifestyle and finances.

Did You Know?

54% of Canadians are paying more attention to their day-to-day living expenses

Source: RBC 2023 Financial Independence Poll

Additional Resources

First Home Savings Account (FHSA)

Save for your first home, tax-free

A simple way to manage your day to day spending

Stay connected to your money and get help reaching your goals

Canadians have a lot of misconceptions about how credit scores work, from how they’re calculated to what makes them go up or down. We debunk 5…

Parents can empower their kids to explore the digital world safely by using the right tools and setting healthy boundaries. Here’s how.

Your money matters. It matters to you, your quality of life, your family and your overall well-being. Now that you're here, explore the many facets of…

Did You Know?

44% of Canadians were not prepared for the impact of inflation

Source: RBC 2023 Financial Independence Poll

Most Popular

-

Bank of Canada Interest Rate Explained and How It Shapes Your Mortgage

The Bank of Canada announcement: interest rates are holding steady. Learn how you could benefit from buying a pre-construction home

-

What is a credit card cash advance rate — and how does it work?

If you're short on cash, a credit card cash advance can be a great option to afford a purchase. Here's your guide to all things cash advance rates and how they work.

-

5 Myths about Your Credit Score

Canadians have a lot of misconceptions about how credit scores work, from how they’re calculated to what makes them go up or down. We debunk 5 common credit score myths so you can improve your financial health.

Which of the following Cyber Security issues do you struggle with the most?

- Remembering passwords (43.02%)

- Recognizing phishing attempts (9.30%)

- Keeping devices secure from hackers (20.60%)

- Staying up to date with security practices (0%)

1 in 5 businesses experienced payment fraud within the last 6 months.

The Bank of Canada announcement: interest rates are holding steady. Learn how you could benefit from buying a pre-construction home

Learn the benefits of early mortgage renewal, especially in an uncertain economy.

Did You Know?

67% of Canadians are concerned about their cash flow

Source: RBC 2023 Financial Independence Poll

Tools & Calculators

See How Much You Could Save in a Registered Retirement Savings Plan

Quickly See What Your Mortgage Payments Might Look Like

Estimate the cost to buy and own an electric vehicle in Canada, compared to a gas model.

Ideas & Voices

Here are five people you should not share your data with.

Buying a home is a happy choice for many families, but it’s a big investment. Learn how optional mortgage protection insurance can help safeguard…

It's important to take steps to protect your personal information — and the good news is, these steps aren't difficult or time-consuming.

Did You Know?

54% of Canadians are paying more attention to their day-to-day living expenses

Source: RBC 2023 Financial Independence Poll

Additional Resources

First Home Savings Account (FHSA)

Save for your first home, tax-free

A simple way to manage your day to day spending

Stay connected to your money and get help reaching your goals

Getting payroll wrong can cost you – from government fines to audits to unhappy employees. Learn how the right processes can make payroll…

Explore the real stories behind Canadian businesses — from getting started to scaling up—and the turning points that made it happen.

A Point of Sale (POS) system does more than process payments. The right one can help streamline your business’s sales process, provide valuable…

Did You Know?

44% of Canadians were not prepared for the impact of inflation

Source: RBC 2023 Financial Independence Poll

Most Popular

-

How Horizon Grains Realized Exponential Growth by Expanding to New Markets

With the help of the right resources and expertise, Horizon Grains Canada increased their revenue by 1150% in 6 years by expanding to new global markets.

-

How Duer Brought the World’s Most Comfortable Pants to a Global Market

Gary Lenett's path to a global business began from the bike lane. Learn how he launched Duer and took it to over two dozen countries.

-

7 Ways to Attract and Hire Employees in a Tight Labour Market

As Canada's labour shortages are likely to worsen, small businesses must find ways to fill vacancies in order to thrive and grow.

Which of the following Cyber Security issues do you struggle with the most?

- Remembering passwords (43.02%)

- Recognizing phishing attempts (9.30%)

- Keeping devices secure from hackers (20.60%)

- Staying up to date with security practices (0%)

Spend less time chasing funds and more time growing your business.

1 in 5 businesses experienced payment fraud within the last 6 months.

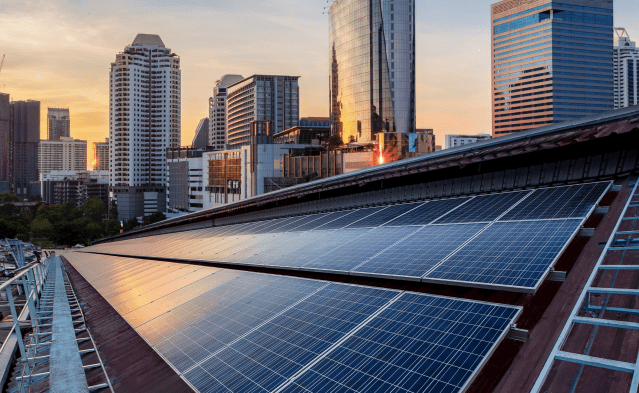

Learn about the Vancouver Greenhouse Gas and Energy Limits bylaw, what’s required from building owners and the resources available to support your…

Did You Know?

67% of Canadians are concerned about their cash flow

Source: RBC 2023 Financial Independence Poll

Tools & Calculators

See How Much You Could Save in a Registered Retirement Savings Plan

Quickly See What Your Mortgage Payments Might Look Like

Estimate the cost to buy and own an electric vehicle in Canada, compared to a gas model

Ideas & Voices

Two years after originally meeting Quill, we re-connected with its founder and CEO to see how business is going.

Starting a business is becoming an increasingly mainstream option for Canadians. These 5 tips can help you get yours off the ground.

Political cartoonist Andy Donato shares his remarkable story in front of a live audience.

Did You Know?

54% of Canadians are paying more attention to their day-to-day living expenses

Source: RBC 2023 Financial Independence Poll

Additional Resources

First Home Savings Account (FSHA)

Save for your first home, tax-free

A simple way to manage your day to day spending

Stay connected to your money and get help reaching your goals

Building family wealth and leaving a legacy you’ll be proud of requires deliberate action across life’s different stages.

Here are 10 tips to help you save money, so you can make your financial goals a reality

A varied asset mix can help boost your portfolio during economic uncertainty

Did You Know?

44% of Canadians were not prepared for the impact of inflation

Source: RBC 2023 Financial Independence Poll

Most Popular

-

TFSA Accounts: What They Are and How They Work

This guide offers an overview of tax-free savings accounts (TFSAs) and how they work. Learn the benefits of having a TFSA, the ins and outs of contributing to the account, investing options and beneficiary implications.

-

How Can I Save Enough to Comfortably Retire?

We've got a simple answer to this age-old question about retirement.

-

7 Strategies for Success in Volatile Markets

Selling may be your gut reaction when portfolio values drops. This is what you should do instead.

Which of the following Cyber Security issues do you struggle with the most?

- Remembering passwords (43.02%)

- Recognizing phishing attempts (9.30%)

- Keeping devices secure from hackers (20.60%)

- Staying up to date with security practices (0%)

This guide outlines the basics of investing in Canada to help you get comfortable before you invest

Here’s a quick rundown on mutual funds – how they work and why they’re popular.

Learn the differences between saving and investing and how to decide the best move for your money.

Did You Know?

67% of Canadians are concerned about their cash flow

Source: RBC 2023 Financial Independence Poll

Tools & Calculators

See How Much You Could Save in a Registered Retirement Savings Plan

Quickly See What Your Mortgage Payments Might Look Like

Estimate the cost to buy and own an electric vehicle in Canada, compared to a gas model

Ideas & Voices

The most obvious effect of inflation is that everything becomes more expensive and the cost of living rises. Here's what that means for your…

An expert shares five approaches for taking the stress out of couples' conversations about finances, budgeting and investing.

Selling may be your gut reaction when portfolio values drops. This is what you should do instead.

Did You Know?

54% of Canadians are paying more attention to their day-to-day living expenses

Source: RBC 2023 Financial Independence Poll

Additional Resources

First Home Savings Account (FSHA)

Save for your first home, tax-free

A simple way to manage your day to day spending

Stay connected to your money and get help reaching your goals

Money Academy

Learn the basics about budgeting, investing & borrowing, and how interest rates and inflation impact your bottom line.