What Matters Now

What’s On Your Mind?

Latest Articles

Canadians have a lot of misconceptions about how credit scores work, from how they’re calculated to what makes them go up or down. We debunk 5…

Parents can empower their kids to explore the digital world safely by using the right tools and setting healthy boundaries. Here’s how.

New to Canada? Learn how loyalty rewards credit cards work, why they matter, how they can help you earn rewards and build credit as you build your new…

Did You Know?

44% of Canadians were not prepared for the impact of inflation

Source: RBC 2023 Financial Independence Poll

Most Popular

-

How Horizon Grains Realized Exponential Growth by Expanding to New Markets

With the help of the right resources and expertise, Horizon Grains Canada increased their revenue by 1150% in 6 years by expanding to new global markets.

-

Bank of Canada Interest Rate Explained and How It Shapes Your Mortgage

The Bank of Canada announcement: interest rates are holding steady. Learn how you could benefit from buying a pre-construction home

-

How Duer Brought the World’s Most Comfortable Pants to a Global Market

Gary Lenett's path to a global business began from the bike lane. Learn how he launched Duer and took it to over two dozen countries.

Which of the following Cyber Security issues do you struggle with the most?

- Remembering passwords (42.90%)

- Recognizing phishing attempts (9.18%)

- Keeping devices secure from hackers (20.70%)

- Staying up to date with security practices (0%)

Your money matters. It matters to you, your quality of life, your family and your overall well-being. Now that you're here, explore the many facets of…

Getting payroll wrong can cost you – from government fines to audits to unhappy employees. Learn how the right processes can make payroll…

Explore the real stories behind Canadian businesses — from getting started to scaling up—and the turning points that made it happen.

Did You Know?

67% of Canadians are concerned about their cash flow

Source: RBC 2023 Financial Independence Poll

Tools & Calculators

See How Much You Could Save in a Registered Retirement Savings Plan

Quickly See What Your Mortgage Payments Might Look Like

Estimate the cost to buy and own an electric vehicle in Canada, compared to a gas model.

Ideas & Voices

Recovery could be slow, even if tariffs issues are settled, due to anticipated cuts to interest rates.

The top scams of 2025 are a mix of old and new as fraudsters draw on proven techniques and add modern twists.

Giving back to the community is valued in Canadian society, but it’s also a great way for newcomer to Canada to gain Canadian experience, showcase…

Did You Know?

Over half of Canadians believe retiring comfortably is their most important investing goal

Source: RBC 2023 Financial Independence Poll

Additional Resources

First Home Savings Account (FSHA)

Save for your first home, tax-free

A simple way to manage your day to day spending

Stay connected to your money and get help reaching your goals

Canadians have a lot of misconceptions about how credit scores work, from how they’re calculated to what makes them go up or down. We debunk 5…

When money worries weigh you down, bottling those feelings up can make them an even heavier burden. Here’s how talking about them can improve your…

Master your post-grad finances with this essential guide to help you navigate student debt and building a solid financial foundation in Canada.

Did You Know?

44% of Canadians were not prepared for the impact of inflation

Source: RBC 2023 Financial Independence Poll

Most Popular

-

5 Myths about Your Credit Score

Canadians have a lot of misconceptions about how credit scores work, from how they’re calculated to what makes them go up or down. We debunk 5 common credit score myths so you can improve your financial health.

-

5 Tips to Help Keep Your Credit Score in Good Standing

Keeping a healthy credit score is about more than just watching what you spend. Follow these tips to help keep your score credit-worthy.

-

How to Maintain a Strong Credit Score During Challenging Times

While credit can act as a financial safety net during tight times, it’s important to maintain a strong credit score in the meantime. Here’s why – and how.

Which of the following Cyber Security issues do you struggle with the most?

- Remembering passwords (42.90%)

- Recognizing phishing attempts (9.18%)

- Keeping devices secure from hackers (20.70%)

- Staying up to date with security practices (0%)

Financial secrets can derail a relationship. Learning how to address them can rebuild trust.

The cash back and rewards you earn on everyday spending with loyalty programs and credit cards can really add up.

A major life change doesn’t have to be a set back – it can be powerful, positive and rejuvenating. Here’s how to navigate it all with…

Did You Know?

67% of Canadians are concerned about their cash flow

Source: RBC 2023 Financial Independence Poll

Tools & Calculators

See How Much You Could Save in a Registered Retirement Savings Plan

Quickly See What Your Mortgage Payments Might Look Like

Estimate the cost to buy and own an electric vehicle in Canada, compared to a gas model.

Ideas & Voices

The RBC Student Budget Breakdown series compares how different students across the country are managing their money. Check out Noshin's budget.

Caribbean businesses are affected by today's global issues and certain unavoidable regional circumstances. Get valuable tips to help prepare your…

Who knew the Golden Girls were predicting the future of retirement when they were discussing Blanche's dating life?

Did You Know?

54% of Canadians are paying more attention to their day-to-day living expenses

Source: RBC 2023 Financial Independence Poll

Additional Resources

First Home Savings Account (FHSA)

Save for your first home, tax-free

A simple way to manage your day to day spending

Stay connected to your money and get help reaching your goals

Since 2009, the National Association of Realtors® (NAR) has conducted an annual survey to measure the volume of U.S. residential real estate…

The Bank of Canada announcement: interest rates are holding steady. Learn how you could benefit from buying a pre-construction home

Learn the benefits of early mortgage renewal, especially in an uncertain economy.

Did You Know?

44% of Canadians were not prepared for the impact of inflation

Source: RBC 2023 Financial Independence Poll

Most Popular

-

Bank of Canada Interest Rate Explained and How It Shapes Your Mortgage

The Bank of Canada announcement: interest rates are holding steady. Learn how you could benefit from buying a pre-construction home

-

The Million Dollar Retirement Myth: What Does It Really Take to Retire Today?

How much do you need to retire? The million-dollar myth is out. Instead, focus on your individual needs to determine your savings goal.

-

Selling Your U.S. Property? 6 Things Canadians Need to Know

If you're preparing to sell your U.S. home, a bit of advance planning can make things easier.

Which of the following Cyber Security issues do you struggle with the most?

- Remembering passwords (42.90%)

- Recognizing phishing attempts (9.18%)

- Keeping devices secure from hackers (20.70%)

- Staying up to date with security practices (0%)

Under 30 and looking to buy your first home? The right savings habits and a smart plan could bring your goal within reach faster.

Explore the top travel destinations in Canada you can enjoy without breaking the bank.

Learn how to earn, redeem, and maximize your travel points.

Did You Know?

67% of Canadians are concerned about their cash flow

Source: RBC 2023 Financial Independence Poll

Tools & Calculators

See How Much You Could Save in a Registered Retirement Savings Plan

Quickly See What Your Mortgage Payments Might Look Like

Estimate the cost to buy and own an electric vehicle in Canada, compared to a gas model.

Ideas & Voices

There's nothing like a road trip. A car full of your favourite people, abundant snacks and your best music. A sense of independence as you set your…

From school to retirement, 3 investors share how they use their TFSA. Find out more.

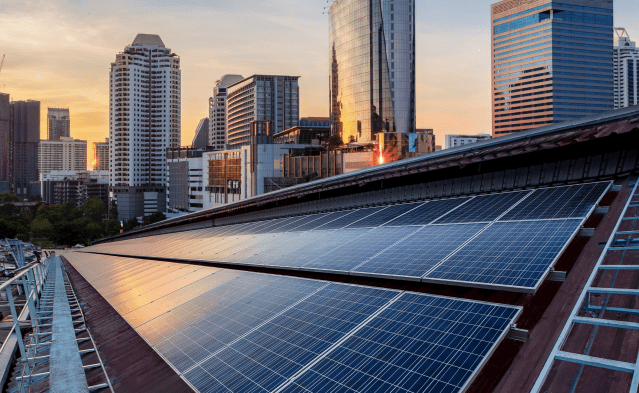

An energy-efficient "green home" could lower your utility bills and reduce your home’s greenhouse gas emissions.

Did You Know?

Over half of Canadians believe retiring comfortably is their most important investing goal

Source: RBC 2023 Financial Independence Poll

Additional Resources

First Home Savings Account (FHSA)

Save for your first home, tax-free

A simple way to manage your day to day spending

Stay connected to your money and get help reaching your goals

Parents can empower their kids to explore the digital world safely by using the right tools and setting healthy boundaries. Here’s how.

New to Canada? Learn how loyalty rewards credit cards work, why they matter, how they can help you earn rewards and build credit as you build your new…

Building family wealth and leaving a legacy you’ll be proud of requires deliberate action across life’s different stages.

Did You Know?

44% of Canadians were not prepared for the impact of inflation

Source: RBC 2023 Financial Independence Poll

Most Popular

-

How does credit card interest rate work

Credit cards can be a helpful financial tool but beware of interest charges. Here’s how credit card interest rates work.

-

What is a credit card cash advance rate — and how does it work?

If you're short on cash, a credit card cash advance can be a great option to afford a purchase. Here's your guide to all things cash advance rates and how they work.

-

Bringing Money to Canada and Sending Money Overseas as a Newcomer

Whether you’re bringing funds to Canada with you or sending money back to your loved ones, here’s how to transfer money securely.

Which of the following Cyber Security issues do you struggle with the most?

- Remembering passwords (42.90%)

- Recognizing phishing attempts (9.18%)

- Keeping devices secure from hackers (20.70%)

- Staying up to date with security practices (0%)

Financial secrets can derail a relationship. Learning how to address them can rebuild trust.

Moving to a new country is full of unknowns. But help is out there for newcomers, and financial success is possible through open conversations about…

While Money is the number one thing couples fight about, love and money can co-exist! Here’s how

Did You Know?

67% of Canadians are concerned about their cash flow

Source: RBC 2023 Financial Independence Poll

Tools & Calculators

See How Much You Could Save in a Registered Retirement Savings Plan

Quickly See What Your Mortgage Payments Might Look Like

Estimate the cost to buy and own an electric vehicle in Canada, compared to a gas model.

Ideas & Voices

There's nothing like a road trip. A car full of your favourite people, abundant snacks and your best music. A sense of independence as you set your…

From school to retirement, 3 investors share how they use their TFSA. Find out more.

An energy-efficient "green home" could lower your utility bills and reduce your home’s greenhouse gas emissions.

Did You Know?

54% of Canadians are paying more attention to their day-to-day living expenses

Source: RBC 2023 Financial Independence Poll

Additional Resources

First Home Savings Account (FHSA)

Save for your first home, tax-free

A simple way to manage your day to day spending

Stay connected to your money and get help reaching your goals

Canadians have a lot of misconceptions about how credit scores work, from how they’re calculated to what makes them go up or down. We debunk 5…

Parents can empower their kids to explore the digital world safely by using the right tools and setting healthy boundaries. Here’s how.

Your money matters. It matters to you, your quality of life, your family and your overall well-being. Now that you're here, explore the many facets of…

Did You Know?

44% of Canadians were not prepared for the impact of inflation

Source: RBC 2023 Financial Independence Poll

Most Popular

-

Bank of Canada Interest Rate Explained and How It Shapes Your Mortgage

The Bank of Canada announcement: interest rates are holding steady. Learn how you could benefit from buying a pre-construction home

-

5 Myths about Your Credit Score

Canadians have a lot of misconceptions about how credit scores work, from how they’re calculated to what makes them go up or down. We debunk 5 common credit score myths so you can improve your financial health.

-

How AI is changing the nature of cybercrime

The scams that are popular today have been around for years. Artificial intelligence (AI) is making them more effective than ever.

Which of the following Cyber Security issues do you struggle with the most?

- Remembering passwords (42.90%)

- Recognizing phishing attempts (9.18%)

- Keeping devices secure from hackers (20.70%)

- Staying up to date with security practices (0%)

1 in 5 businesses experienced payment fraud within the last 6 months.

The Bank of Canada announcement: interest rates are holding steady. Learn how you could benefit from buying a pre-construction home

Learn the benefits of early mortgage renewal, especially in an uncertain economy.

Did You Know?

67% of Canadians are concerned about their cash flow

Source: RBC 2023 Financial Independence Poll

Tools & Calculators

See How Much You Could Save in a Registered Retirement Savings Plan

Quickly See What Your Mortgage Payments Might Look Like

Estimate the cost to buy and own an electric vehicle in Canada, compared to a gas model.

Ideas & Voices

Credit cards can be a helpful financial tool but beware of interest charges. Here’s how credit card interest rates work.

The grandparent scam is the most common form of cyber scam targeting seniors. Find out what it involves and how to avoid being a victim.

Older adults are common targets of fraud. Find out how to protect your parents – or other seniors in your life – from cyber scams.

Did You Know?

54% of Canadians are paying more attention to their day-to-day living expenses

Source: RBC 2023 Financial Independence Poll

Additional Resources

First Home Savings Account (FHSA)

Save for your first home, tax-free

A simple way to manage your day to day spending

Stay connected to your money and get help reaching your goals

Getting payroll wrong can cost you – from government fines to audits to unhappy employees. Learn how the right processes can make payroll…

Explore the real stories behind Canadian businesses — from getting started to scaling up—and the turning points that made it happen.

A Point of Sale (POS) system does more than process payments. The right one can help streamline your business’s sales process, provide valuable…

Did You Know?

44% of Canadians were not prepared for the impact of inflation

Source: RBC 2023 Financial Independence Poll

Most Popular

-

How Horizon Grains Realized Exponential Growth by Expanding to New Markets

With the help of the right resources and expertise, Horizon Grains Canada increased their revenue by 1150% in 6 years by expanding to new global markets.

-

How Duer Brought the World’s Most Comfortable Pants to a Global Market

Gary Lenett's path to a global business began from the bike lane. Learn how he launched Duer and took it to over two dozen countries.

-

Learn How the Canada Small Business Financing Program Can Help Grow Your Business

The CSBF program helps business owners access financing to start and grow their businesses. Here are answers to the top questions about CSBF.

Which of the following Cyber Security issues do you struggle with the most?

- Remembering passwords (42.90%)

- Recognizing phishing attempts (9.18%)

- Keeping devices secure from hackers (20.70%)

- Staying up to date with security practices (0%)

Spend less time chasing funds and more time growing your business.

1 in 5 businesses experienced payment fraud within the last 6 months.

Learn about the Vancouver Greenhouse Gas and Energy Limits bylaw, what’s required from building owners and the resources available to support your…

Did You Know?

67% of Canadians are concerned about their cash flow

Source: RBC 2023 Financial Independence Poll

Tools & Calculators

See How Much You Could Save in a Registered Retirement Savings Plan

Quickly See What Your Mortgage Payments Might Look Like

Estimate the cost to buy and own an electric vehicle in Canada, compared to a gas model

Ideas & Voices

While recent events in the Red Sea have caused temporary setbacks, the bigger picture reveals a combination of factors contributing to challenges for…

Sustainable practices can drive innovation, attract like-minded investors and employees, and foster stronger community relations.

By striving to diversify its supply chain, a company can help to level the playing field for diverse suppliers.

Did You Know?

54% of Canadians are paying more attention to their day-to-day living expenses

Source: RBC 2023 Financial Independence Poll

Additional Resources

First Home Savings Account (FSHA)

Save for your first home, tax-free

A simple way to manage your day to day spending

Stay connected to your money and get help reaching your goals

Building family wealth and leaving a legacy you’ll be proud of requires deliberate action across life’s different stages.

Here are 10 tips to help you save money, so you can make your financial goals a reality

A varied asset mix can help boost your portfolio during economic uncertainty

Did You Know?

44% of Canadians were not prepared for the impact of inflation

Source: RBC 2023 Financial Independence Poll

Most Popular

-

Compound Interest: How It Works and Why It’s Amazing

Find out why 'interest on interest' is important and how it can make your wealth grow faster.

-

TFSA or RRSP: How to Find the Right Fit in 2025

Asking yourself these three questions about your goals, tax considerations and contribution room can help you make the right decision.

-

In the intricate dance of managing finances as a couple, optimizing your retirement savings becomes one of the key dance steps. One sometimes helpful move is a Spousal Registered Retirement Savings Plan (Spousal RRSP), which can offer some financial and tax benefits for couples.

Which of the following Cyber Security issues do you struggle with the most?

- Remembering passwords (42.90%)

- Recognizing phishing attempts (9.18%)

- Keeping devices secure from hackers (20.70%)

- Staying up to date with security practices (0%)

This guide outlines the basics of investing in Canada to help you get comfortable before you invest

Here’s a quick rundown on mutual funds – how they work and why they’re popular.

Learn the differences between saving and investing and how to decide the best move for your money.

Did You Know?

67% of Canadians are concerned about their cash flow

Source: RBC 2023 Financial Independence Poll

Tools & Calculators

See How Much You Could Save in a Registered Retirement Savings Plan

Quickly See What Your Mortgage Payments Might Look Like

Estimate the cost to buy and own an electric vehicle in Canada, compared to a gas model

Ideas & Voices

The First Home Savings Account, or FHSA, is a new registered plan that can help you save for your first home tax-free. Is it right for you?

From continuous learning to adaptability, a career coach shares which skills can help you cement your position at work.

Here’s how you can talk money with friends.

Did You Know?

54% of Canadians are paying more attention to their day-to-day living expenses

Source: RBC 2023 Financial Independence Poll

Additional Resources

First Home Savings Account (FSHA)

Save for your first home, tax-free

A simple way to manage your day to day spending

Stay connected to your money and get help reaching your goals

Money Academy

Learn the basics about budgeting, investing & borrowing, and how interest rates and inflation impact your bottom line.